LOS ANGELES — The Free Speech Coalition has published a guide for members on how to navigate the new reporting requirements implemented by the Financial Crimes Enforcement Network (FinCEN).

The text of the guide follows:

As of January 1st, 2024, the United States Financial Crimes Enforcement Network (FinCEN) has implemented new reporting requirements aimed at combating financial crimes. The Free Speech Coalition encourages its members who own businesses to ensure compliance with these regulations. Here’s what you’ll need to know to navigate FinCEN's new beneficial ownership information reporting requirements.

Understanding the Reporting Requirements: Who Does This Apply to?

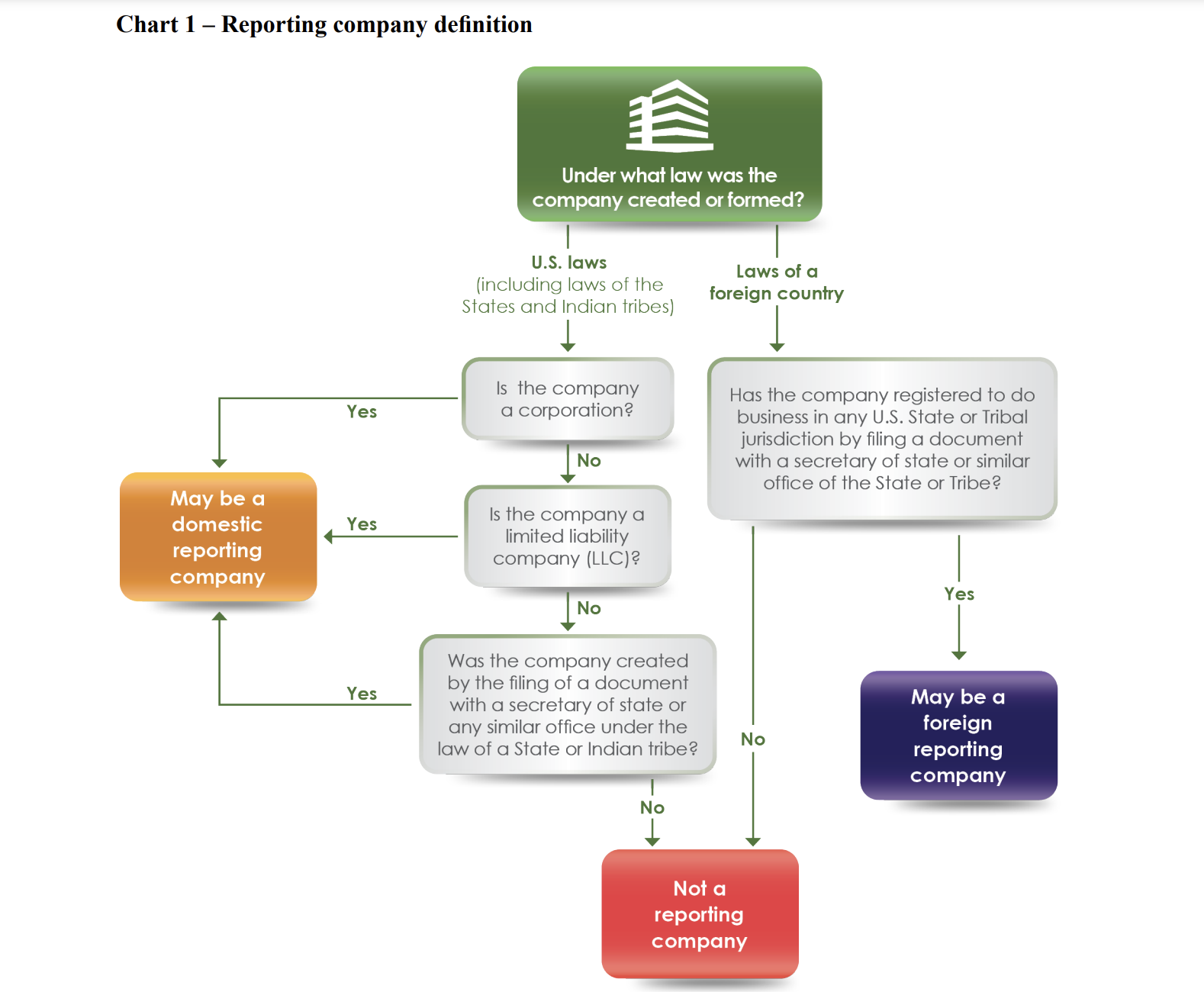

These reporting requirements primarily concern companies doing business in the United States, including those owned by members of the Free Speech Coalition. The FinCEN Small Entities Compliance Guide outlines which companies are required to report and which companies are exempt. To determine whether the requirements apply to you, refer to the chart below, which is also listed on page 9 of the Small Entities Compliance Guide.

If your company is a reporting company, your next step is to identify its beneficial owners. A beneficial owner is any individual who, directly or indirectly, exercises substantial control over a company or owns or controls at least 25 percent of its ownership interests. Companies are required to identify and report all owners and beneficiaries.How to Report:

Reporting companies must file their reports electronically through the FinCEN secure filing system, which is available as of January 1, 2024. FinCEN has published instructions and technical guidance on how to complete the report form on their website. If a reporting company is unable to file electronically, they should contact FinCEN for assistance. You also have the option to create a FinCEN ID.

What You Need to Report:

Reporting companies must provide specific information about each beneficial owner, including their name, date of birth, address, and identifying number and issuer from an accepted identification document. Additionally, information about the company itself, such as its name and address, must be submitted.

Deadlines for Reporting Requirements

For existing companies, the deadline for filing initial reports is January 1, 2025. New companies created or registered in 2024 must file within 90 calendar days after their creation or registration.

Useful Resources for Compliance:

FinCEN provides various resources to facilitate compliance, including a Small Entity Compliance Guide, informational videos, webinars, an FAQ and a contact center. These resources can be accessed on the FinCEN website.

For more detailed information and frequently asked questions, refer to FinCEN's informational brochure here.