LOS ANGELES — There’s a lot that businesses in the adult entertainment industry can learn from their mainstream counterparts, whether they operate in the content creation and distribution arena; product production, retail and wholesale spaces; or beyond. Indeed, even the way that businesses are capitalized and conducted can share many similarities and provide inspiration for one another.

One example can be found in a recent dissection of a popular music streaming service, which provides some insights and metrics that could be of benefit to adult tube site operators and other media providers. Writing for Stratechery.com, Ben Thompson’s in-depth “Lessons from Spotify” explores the economics and nature of serving streaming media to consumers today, providing valuable intelligence through this case study.

Thompson kicked-off the article by noting the two dominant business models for venture-backed startups are advertising for consumer-focused companies, and Software-as-a-Service (SaaS) for business-focused ones.

“On one level, these business models are quite different: the former gives away software for free with the hope of convincing a third party to pay for access to users; the latter charges some portion of users directly,” Thompson wrote. “The underlying economics of both, though, are more similar than you might think — indeed, both are very much in line with venture-backed startups of the past.”

He then went on to use the example of computer chip manufacturing, where the main ingredient, sand, is inexpensive, but development is costly, and explained that regardless of the business sector or industry, “the fundamental economic rationale for taking on venture capital is the same: spend a lot of money up-front to develop and build a product, and take advantage of minimal marginal costs to make it up in volume.”

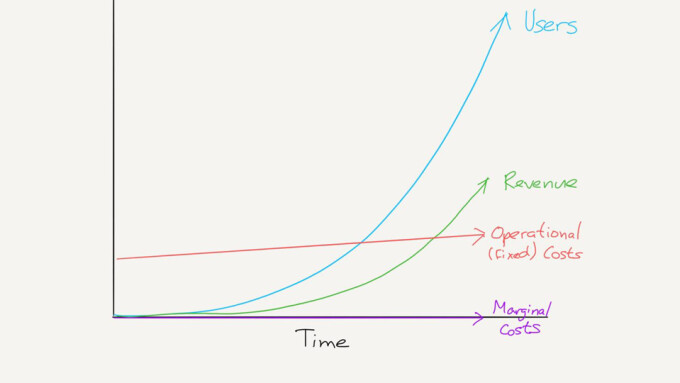

“Advertising-based consumer companies spend huge amount of R&D building products that appeal to users, although usually not a lot on sales and marketing to acquire users; consumer companies that break through to the scale necessary to support advertising rely on viral network effects. Where the sales and marketing spend comes is in courting advertisers; however, the most valuable consumers companies of all — the super-aggregators — generate the same sort of network effects allowing them to add advertisers in a scalable way as well,” Thompson explains. “This produces the ideal venture outcome: a company where users and revenue grow far more quickly than costs.”

Thompson cites the importance of having minimal marginal costs for a streaming site such as Spotify to succeed, but notes the royalties to publishers, record labels, and songwriters amp up Spotify’s marginal costs. He also notes that SaaS companies tend to spend less than 10 percent of marginal revenue per customer on service delivery.

“More users are not necessarily more expensive. Of course, fixed costs grow over time, but they only grow linearly — earning ever-increasing revenue on a relatively stable cost basis is the definition of scale,” Thompson adds. “SaaS businesses have the same sort of profile — the big difference is that revenue comes from users, and thus sales and marketing expenses are spent on gaining said users, not advertisers, but minimal marginal costs are the common thread.”

Adult tube sites, for example, rose in prominence in part because their content costs were so low (and in the case of pirate sites, nonexistent), but increases in visitor volume brought revenues that allowed for investment in content, putting them more akin to paysites, expense-wise. Indeed, some of the measures Spotify took mirror the measures taken by some adult tube sites that partnered with studios, often garnering mixed results.

“Spotify negotiated new deals with the record labels last summer that resulted in lower royalty rates in exchange for guaranteed subscriber growth and the ability for the labels to make some releases exclusive to Spotify’s paid tier,” Thompson wrote, adding, “Spotify’s margins are completely at the mercy of the record labels, and even after the rate change, the company is not just unprofitable, its losses are growing.”

This means new approaches are need, with Thompson noting how “piracy drove the music labels into the arms of Apple, which unbundled the album into the song,” pointing to the seismic shifts often necessary to reset the playing field.

“Streaming has rewarded the integration of back catalogs and new music with bundle economics: [now] more and more users are willing to pay $10/month for access to everything, significantly increasing the average revenue per customer,” Thompson says. “The result is an industry that looks remarkably similar to the pre-internet era.”

Underpinning the process is “service,” encompassing software and servitude with comprehensive offers to make customers smile.

“I still believe in a future where Everything is a Service, and there’s no question that creating networks for everything will need a lot of venture capital. And make no mistake — there will continue to be capital available, because a network, once made, absolutely offers the sort of scalable revenue generation that makes generating significant profits an inevitability,” Thompson concluded. “To that end, it is surely Spotify’s hope that the streaming market ends up being so big that the company’s low gross margin in percentage terms ends up large in absolute ones; even then those profits will come from operational excellence and efficient customer acquisition, not simply top-line growth.”

Sure, Thompson’s piece is heady stuff, but it is exactly the type of analysis that all growth-focused media companies, adult or otherwise, need to focus on if they are to better understand the fundamentals, risks and opportunities of their market. Such efforts can help the smallest of sites grow into the biggest of brands and should not be overlooked.

The full article can be read here.