On a recent cross-country flight to Los Angeles, I surfed away wirelessly at 35,000 feet. I looked around to see the faces of many other passengers buried in their laptops and smartphones and wondered how many were actually conducting business while in flight. Being in the business of preventing online financial fraud, I wondered how many of them were at risk of having their valuable assets stolen.

A few weeks back, I read an article written by consumer advocate Clark Howard, warning consumers to be on alert for online thieves stealing frequent flyer miles, using them for front-of-the-plane tickets and then selling them to make money. If you’re like most people, you might think, “It’s an airline account, who would want to get into it?” As a result, people tend to make their usernames and passwords too simple. Thieves have caught on and are taking advantage. Fraud has literally taken flight. We must be more vigilant than ever in protecting personal data and privacy — both online and off.

Protecting your personal data and privacy is not only the responsibility of the companies you do business with — it’s also your own. Each of us has to be aware that thieves are lurking and waiting for that one crack in the dam that lets them steal all the water!

The same goes for our homes. So-called “smart devices” such as Amazon’s Alexa and the Nest thermostat have revolutionized everything from the way we consume music to the way we conserve energy. But just who is listening and learning on the other end of those devices? What are they doing with the information the devices collect? According to reports, Amazon keeps recordings of what you’ve said. Anyone with your phone, and access to your Amazon account, can read through what you’ve recently said. Plus, your dialogue with your smart device is stored on Amazon servers for analysis. Hackers could take over the device and gain access to it all.

We’ve become so accustomed to using our voices to serve up our favorite hits, and turn down the heat, we may have forgotten an important lesson: Keep your personal information private — don’t just give it away.

Protecting your personal data and privacy is not only the responsibility of the companies you do business with — it’s also your own. Each of us has to be aware that thieves are lurking and waiting for that one crack in the dam that lets them steal all the water. For example, when you partake in one of those games or quizzes on social media, do you realize that you’re often granting access to your contacts and photos? CBS News recently reported that between 75 percent and 80 percent of free apps were breached. It’s even higher with paid apps at 97 percent. By using these apps and playing certain games, you’re saying it’s OK to access your personal info. They can track things like your phone calls, your GPS or contacts, and build a file on you. Is it worth risking identity theft to learn what Thanksgiving food you are, or which punk rock icon you most resemble?

For the record, I got cranberry sauce and Joan Jett. But I digress.

Those examples might be a bit innocuous, but others are insidious. There are data thieves among us and we must remain hyper-vigilant in protecting our critical data and personal privacy. As a payment processor we use some sophisticated algorithms to detect and prevent credit card fraud, but we also incorporate simple, common-sense measures such as not accepting payment in cases when an email address or other personal data has been associated with fraud in the past.

To that end, here are five simple tips you can use to protect your data and privacy:

1. Install screen protectors for your phone or tablet

They keep your device intact if you drop it, while also protecting against would-be spies. When you look straight into the screen, it’s totally clear — but if a stranger tries to look at your screen from an angle, it appears dark. Bingo, no more snooping seatmates on your next flight.

2. Install a camera cover on your phone or computer

This is another inexpensive way to give yourself a little more peace of mind when it comes to your privacy. No one wants a stranger looking at us through a camera we don’t know is on. Former FBI Director James Comey told The Hill that he puts a piece of tape over the camera on his computer, equating it to locking your car door when you exit the vehicle.

3. Unplug Alexa or other voice-controlled devices when they’re not in use

Again, perhaps an obvious suggestion, but it’s a small step in making sure no one is listening when you don’t want them to. Wired reported in 2018 that the security firm Checkmarx found a glitch in Amazon’s Alexa that allowed them to easily hack into the popular system. Amazon has since fixed that glitch, according to Wired.

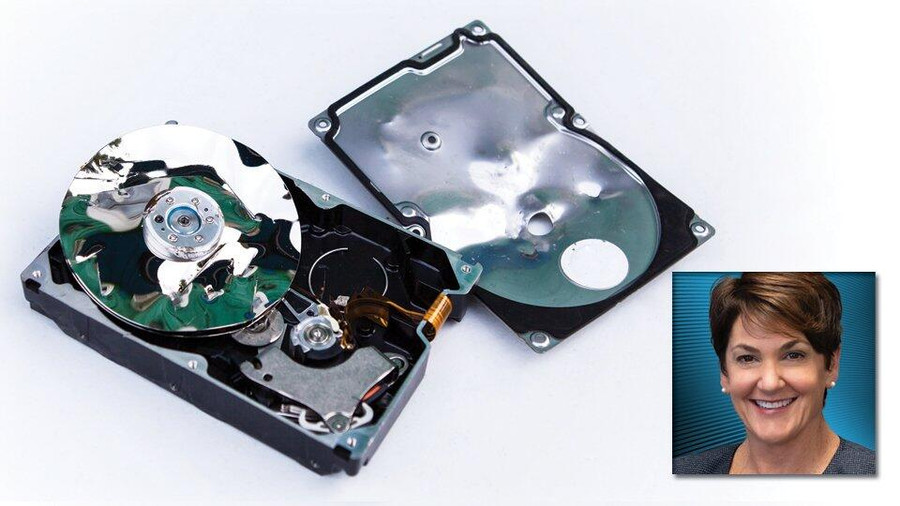

4. Take a hammer to your hard drive — literally

Some people swear by this, especially if they don’t trust others to wipe data from their devices when they reach the end of the technology road. “Which? Computing Magazine” calls smashing your hard drive a simple solution to what could be a serious problem. Be sure to wear safety goggles and dispose of the pieces properly if you do take hammer in hand.

5. Don’t fill out your social media profile

Time called this the No. 1 way to protect your personal information — saying the more information you put out in cyberspace, the more likely you are to have problems.

Like many of you, I travel regularly for business. Going forward, I plan to research and implement additional means to protect my data and privacy, both in the air and on the ground.

Now, if I could only find something to keep me from shopping for shoes on those cross-country flights.

Cathy Beardsley is president and CEO of Segpay, a global leader in merchant services offering a wide range of custom financial solutions including payment facilitator, direct merchant accounts and secure gateway services. Under her direction, Segpay has become one of only four companies approved by Visa to operate as a high-risk internet payment services provider. Segpay offers secure turnkey solutions to accept online payments, with a guarantee that funds are always safe and protected with its proprietary Fraud Mitigation System and customer service and support. For any questions or help, contact compliance@segpay.com.