In late March, the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) announced new regulations to take effect January 2024. These rules will require certain types of corporations, limited liability companies and other similar entities registered in the U.S. to report beneficial ownership information. A beneficial owner is any individual who directly or indirectly exercises “substantial control” over the reporting company, or who directly or indirectly owns or controls 25% or more of the “ownership interests” of the reporting company.

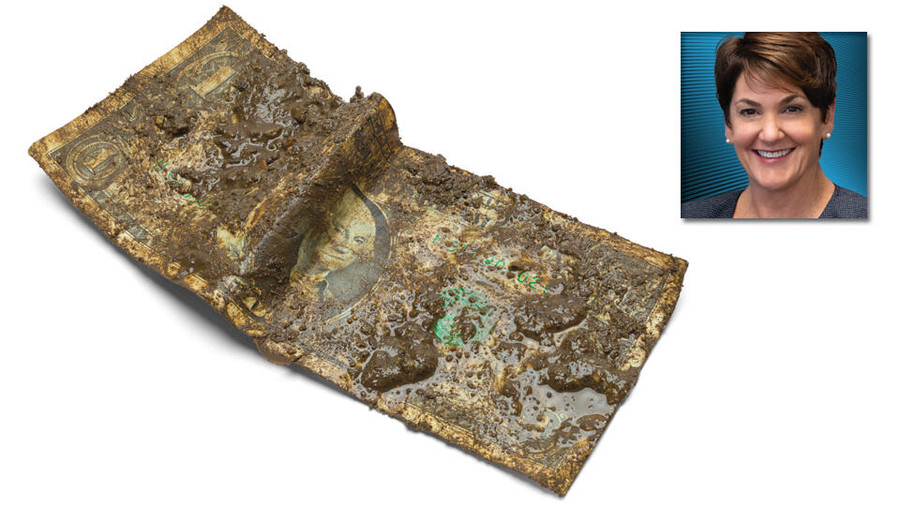

These new rules fall under the Corporate Transparency Act (CTA), and have been in development since 2021 when Congress, with bipartisan support, enacted the CTA to make it harder for bad actors to hide or benefit from their ill-gotten gains or “dirty money.”

Any individual who exercises substantial control over the company or who owns or controls 25% or more interest in an adult website entity must disclose that information.

What does all this mean for your business? We thought it would be beneficial to get out ahead of these new regulations and break down everything you need to know.

Why the New Regulations?

In the U.S., it’s easy to open a business. So easy, in fact, that there are millions of small businesses out there. Most are reputable. These new regulations target companies or individuals going in the wrong direction. For example, entities participating in money laundering, terrorist financing, corruption, tax fraud or other illicit activity.

Fraudsters cheated the system during the COVID lockdowns. The Paycheck Protection Program was an easy target and allowed bad actors to create companies and apply for funds. These new regulations will help to establish a better understanding of who the beneficial owners of these entities are, while making it easier for enforcement agencies to identify and go after fraudulent businesses.

How Will It Work?

Each company will be expected to collect and share their beneficial ownership information with FinCEN starting Jan. 1, 2024. Existing corporations will have a full year to report their information. Companies will report beneficial ownership information to FinCEN through a secure filing system available via FinCEN’s website. This system is currently being developed and will be launched prior to Jan. 1, 2024.

By implementing these regulations, the CTA will provide essential information to law enforcement, national security agencies and others to help prevent criminals, terrorists, proliferators and corrupt oligarchs from hiding illicit money or other property in the U.S.

FinCEN is one of the governing bodies that oversee payment facilitator regulations. All payment processors including Segpay are already obliged to comply with FinCEN regulations. As a PayFac member we are required to have strong Anti-Money Laundering (AML) policies in place. And all merchants are required to submit beneficial ownership information to acquirers and the card brands. Any individual who exercises substantial control over a company or who owns or controls 25 percent or more interest in an adult website entity must disclose that information.

The change is that up to now, very few U.S. states or territories have required companies to disclose the identities of beneficial owners. The CTA authorizes FinCEN to collect this information and disclose it to authorized government agents and financial institutions. This information will only be shared with key constituents such as:

- U.S. federal agencies engaged in national security; intelligence and law enforcement agencies.

- State, local and tribal law enforcement agencies with court authorization.

- The U.S. Department of the Treasury.

- Financial institutions using beneficial ownership information to conduct legally required customer due diligence, provided the financial institutions have customer consent to retrieve the information.

- Federal and state regulators assessing financial institutions for compliance with legally required customer due diligence obligations.

- Foreign law enforcement agencies and certain other foreign authorities that submit qualifying requests for the information through a U.S. federal agency.

Most likely, acquirers will also have access to this information and be required to validate merchant information they have collected relating to what they are required to submit. The good news is that this information will be locked down to select government and financial institutions and not readily available to the public. This will give a level of protection to owners of adult websites, so they don’t become targets of unwarranted attacks from activist groups targeting the industry.

Security and Confidentiality

Protecting the security and confidentiality of beneficial ownership is a top priority for FinCEN. Federal law requires FinCEN to implement protocols to safeguard beneficial ownership information, to build a secure IT system to store that information, and to establish processes and procedures to ensure that beneficial ownership information can only be accessed by authorized users for authorized purposes.

Disclosure of beneficial ownership information is a global concern. In 2018, the EU passed legislation that recognized the importance of corporate ownership transparency. It emphasized that giving the general public access to beneficial ownership registers would help deter financial crime and preserve trust in the integrity of business transactions and the financial system.

Of course, not all individuals were happy with that legislation due to privacy concerns, and some took it to court and won. Today, not all EU member states require beneficial ownership registers. The good news is that unlike the EU/U.K. regulations, the U.S. legislation does not make this information public; it will be private for financial institutions and other government agencies to check and help track down those bad actors.

While many of us are concerned about additional regulation, this one comes with some strong benefits, protecting the system from bad actors who have been able to hide in the shadows. As always, if you have nothing to hide, these new regulations won’t hurt your business. They only make the system stronger and more secure.

Cathy Beardsley is president and CEO of Segpay, a merchant services provider offering a wide range of custom financial solutions including payment facilitator, direct merchant accounts and secure gateway services. Under her direction, Segpay has become one of four companies approved by Visa to operate as a high-risk internet payment services provider. Segpay offers secure turnkey solutions to accept online payments, with a guarantee that funds are kept safe and protected with its proprietary Fraud Mitigation System and customer service and support. For any questions or help, contact sales@segpay.com or compliance@ segpay.com.